Residential Market Update

NICK COWDY / Residential Sales Consultant, Principal Agent

The property market across New Zealand continues to be affected by tighter credit conditions, higher mortgage rates and increased housing supply. The latest data insights from REINZ show that sales are taking longer to complete, properties are staying on the market longer and upward pressure on prices is easing.

The REINZ House Price Index (HPI) for New Zealand, which measures the changing value of residential property nationwide, showed an annual increase of 3.7% from 3,806 in May 2021 to 3,946 in May 2022 – down 7.7% from its peak in November 2021.

Alongside Northland, Canterbury ranked at the top of the HPI for May. Canterbury has been in the top two in terms of HPI movement for eight consecutive months, signalling the underlying strength in our market. In May 2022, an annual increase of 16.5% was recorded for Canterbury, up from 3,223 in May 2021 to 3,754.

“While annual sales counts are down across the country, moving from April to May, there was an uptick in sales activity. The New Zealand sales count was up 11% month-on-month, a smaller increase than we expect to see moving from April to May, based on the seasonally adjusted figure of -3.4%,” says REINZ CEO, Jen Baird.

In Canterbury, the median house price increased steadily to $685,000 – an increase of 18.1% year on year. This continued growth has been driven by districts such as Selwyn and Waimakariri, both of which have reached record medians in eight of the past 12 months. The median house price in Christchurch City has also seen an increase, up 14.5% year on year.

The market in Canterbury is steady, and with the challenging shortages in labour and materials, the demand for completed or renovated homes has never been stronger. Agents are also still seeing an influx of people moving to the region for a better way of life, easier commuting and better value for money in the property market.

What is AML

Anti-money laundering (AML) legislation was enacted in New Zealand in 2003. Money laundering is the process criminals use to ‘clean’ the ‘dirty’ money made from illegal activities, by channelling it into legitimate purchases such as property, expensive goods and financial services.

In 2013, banks, casinos and financial service providers became subject to requirements introduced by the Anti-Money Laundering and Counter Financing of Terrorism Act 2009 (the Act). Following this, the Act imposed obligations on lawyers and accountants, and since 1 January 2019, all real estate agents have also been subject to the requirements of the legislation.

The rationale of the legislation is to better protect New Zealand against criminal activity and enhance our international reputation as a safe place to do business. The requirements of the Act were imposed on real estate agents because the size and scale of property transactions make them an ideal target for those looking to launder money. Real estate values can also sometimes be difficult to assess, meaning that the purchase of real estate can be a way of moving large amounts of money without raising suspicion – therefore allowing criminals to create a false impression of legally acquired wealth.

Criminals use a wide range of strategies to launder money. This can include creating a confusing audit trail by frequently buying and selling property. Another tactic is to pay a large deposit with no real intention of seeing the transaction through, resulting in money being funnelled through a real estate agency’s bank account or a law firm’s trust account before heading back to the criminal as ‘clean’ money. Real estate agents, who work closely with their clients, are in an ideal position to help identify suspicious activity.

The obligations of the Act on real estate agents mean all real estate agents in New Zealand must undertake a high level of client due diligence. This includes requesting information to verify the identity of clients as well as anyone acting on their behalf. This is not optional on our part and is required for each transaction, even for people who have been long-term clients.

Identification needs to be sighted by an agent in the presence of a client or, if this is not possible, the client will need to provide copies of identification documents certified by a solicitor or Justice of the Peace. The information needs to show a name, date of birth and evidence of current residential address. In some situations, the source of clients’ funds may also need to be proven. The required information needs to be provided before a client can enter into an agency agreement with a real estate agent.

All real estate agents now carry out risk assessments and report suspicious activity to the New Zealand Police Financial Intelligence Unit. Additionally, all agents are required to regularly review and maintain their risk assessment, submit an annual report to the Department of Internal Affairs and have an independent audit of their programme completed every three years.

Low Vacancies in Central Christchurch Offices

SAM COWDY / Commercial Sales & Leasing Consultant

Demand from businesses wanting to move back into the Christchurch central city is fuelling a shortage of available office spaces. According to CBRE’s latest survey, the vacancy rate is now well below the pre-earthquake level of 10.1%, recorded in 2010, and dramatically lower than the 16.3% vacancy recorded in 2018 following the opening of several major new office buildings.

Large, open-plan office floors suitable for bigger tenants are exceptionally hard to come by. The availability of spaces over 1,000 square metres in the central business district is restricted severely, and the ongoing increase in tenant demand is heating up the competition for the limited spaces that do become available for immediate occupancy. It’s this same market tightening that is affecting smaller occupiers too, creating strong competition between tenants for high quality spaces.

Additionally, when comparing the leasing market in Christchurch with Auckland and Wellington, it’s apparent that the Christchurch market is not suffering Covid-related disruptions to the same extent as these other main centres. This could be attributed to Christchurch not generally being a location for national head offices, so the office size requirements of tenants in the Christchurch CBD tends to be comparatively smaller. This in turn means the impact of working from home has not been at a level that has prompted a large-scale drive towards subleasing of excess space.

Rent levels for prime central city office buildings also increased more than 15% over the last year, further showcasing that Covid has had a negligible impact on the leasing market in Christchurch’s CBD.

Up until recently, a number of proactive CBD landlords were considering repositioning strategies, such as the conversion of difficult-to-lease older office buildings to hotels, however this stance has moved in the opposite direction with the shift in the market. The favourable conditions for leasing office buildings has owners now considering refurbishment into contemporary office space as a high-value proposition, especially with the shortage in floor space in the market.

If you are a landlord with a commercial space to lease or a tenant looking for commercial premises, get in touch with one of our commercial agents today for a no obligation conversation.

Regulation of Residential Property Managers

JANICE COWDY / Director, Sales and Property Management

Earlier this year, the government sought feedback on proposals for the regulation of residential property managers. While residential property managers who are members of industry bodies follow minimum competency and practice standards, the sector as a whole is not regulated – and New Zealand is one of the few countries in the OECD that does not regulate its property managers.

This lack of regulation has a negative impact on tenants and landlords who are reporting bad experiences due to property managers acting unprofessionally and not being held accountable for their actions. It also jeopardises the reputation of good property managers who are doing a great job in the industry.

A wide range of stakeholders have highlighted the significant risk that a lack of national good practice standards, controls, and an accessible independent disciplinary and disputes resolution process pose to property owners and tenants. Cowdy is a strong supporter of regulation and is part of REINZ’s Call for Change initiative, which has been pushing for regulation since 2019.

With the rental market in New Zealand changing, and a greater portion of people renting, it’s important to make sure the interests of property owners, tenants, and other consumers are protected.

The proposals aim to achieve this through the following:

- Establishing professional entry standards for residential property managers

- Establishing industry practice standards for the delivery of residential property management services

- Providing accountability through an independent, transparent and effective disciplinary complaints resolution process that applies to residential property managers and the delivery of property management services.

Cowdy is proudly a member of the NZ Realtors Network, which filed a submission in support of the regulation of property managers in April this year. Licensing, with a corresponding public register, is a core component of the proposed regulatory system, which the NZ Realtors Network supports. This is seen as a key requirement to ensure minimum standards are maintained across the sector.

It is important that all providers of residential tenancies are governed and supported by some form of entry requirement, training and practice standards, and that tenants and property owners have access to complaints and disciplinary resolutions regardless of the managing party.

Part of the NZ Realtors Network’s submission, which Cowdy is strongly in favour of, requests the government bring forward the commencement date of the proposed regulatory system to late 2024. Property management regulation is needed right now, and taking four years to implement it is too long. Unfortunately, there are some low-cost operators in the market now who, in cutting corners, are putting tenants and owners at risk.

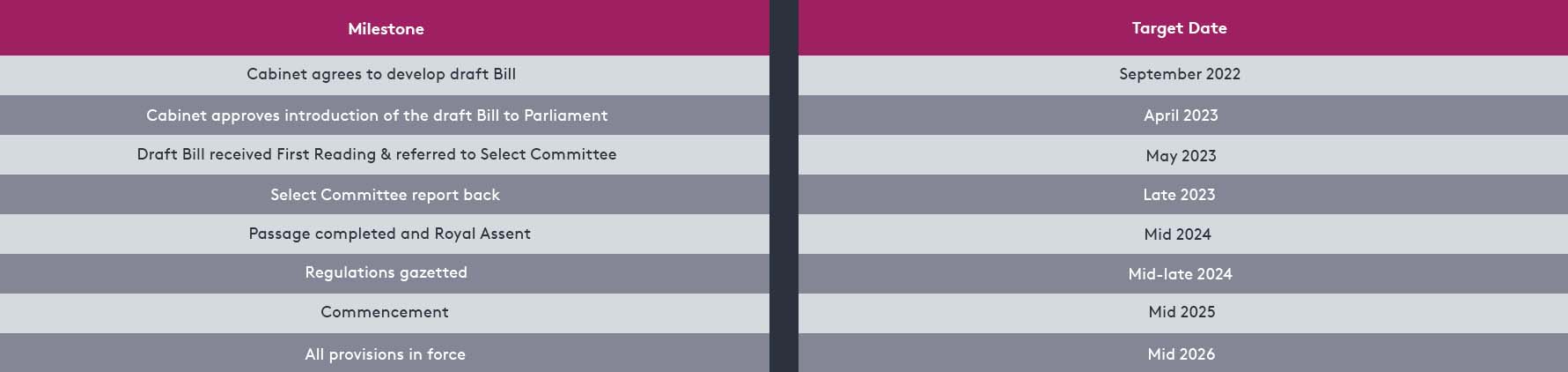

Feedback submissions are currently being analysed and, if agreed by Cabinet, the regulation of residential property managers will require new legislation. The current indicative implementation timeframes are as detailed below:

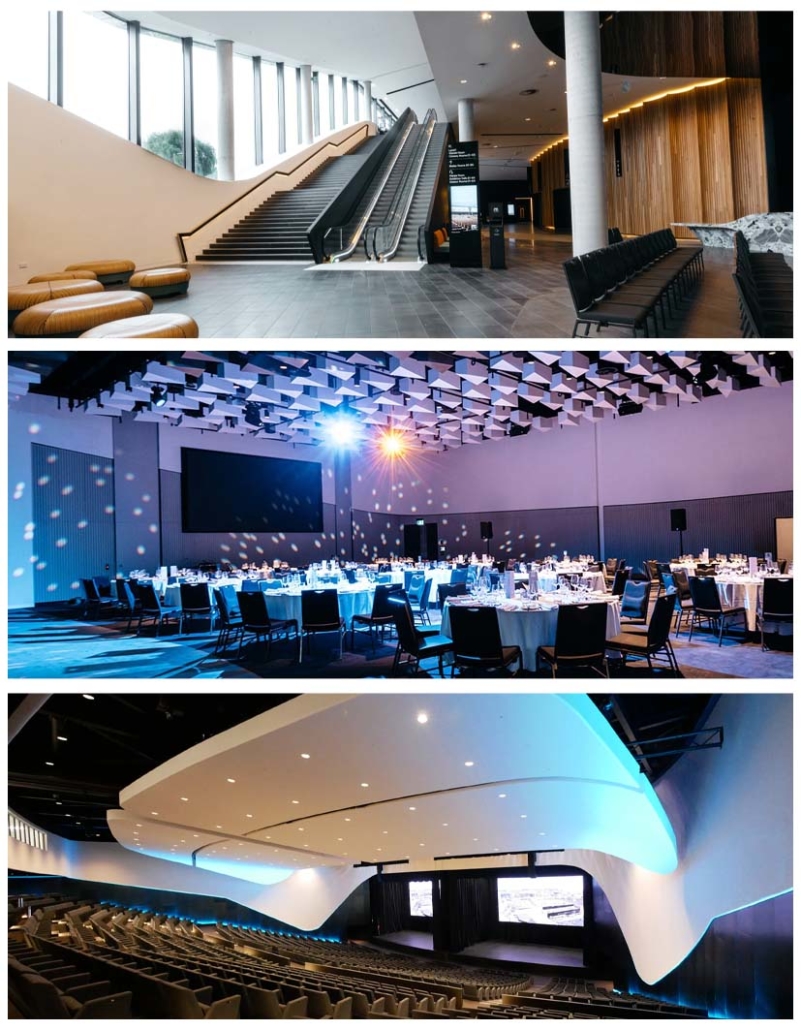

Christchurch Convention Centre

Christchurch’s $450 million convention centre, Te Pae, is officially open after years of planning and four long years of construction. Te Pae is forecast to bring $60 million a year in the economy in Christchurch.

Chief executive of Crown company Ōtākaro, John Bridgman, which has been in charge of getting Te Pae built, said it was “very exciting” to have the building completed.

Bridgman said the numbers attending Te Pae in the next year, along with the partners and families they would bring to the city, “translates into a lot of accommodation and hospitality – a lot of people spending in Christchurch as they come to visit”.

Before the start of 2022, Te Pae already had 100 event bookings for the year including 50 multi-day conferences and 14 medical conferences. The general manager of Te Pae, Ross Steele, said there is “a solid roster of events” booked from 2023 onwards, and they are looking several years ahead at long-term bookings.

Te Pae overlooks the Avon River, Victoria Square and Cathedral Square, and while the building is large for Christchurch, on a global scale it is a boutique convention centre. It came in slightly under budget at just under $450 million, of which $240 million was spent on construction, $74 million on land and $34 million on professional services.

On the exterior of the building, the 43,000 exterior tiles represent Canterbury’s braided rivers, with the river theme carried through to the shape of the windows and the carpet design.

Inside, the reception area has a 2-tonne marble reception desk and timber columns, while the 1400-seat auditorium has a 9-metre by 18.5m screen and can be divided into two 700-seat spaces. Next door, the banquet hall can seat 1000 people and can be used for meetings and seminars.

Downstairs are several meeting rooms, and a 2800-square-metre exhibition hall that can be expanded to 3300m², or divided up.

Megan Crum, head of business events for ChristchurchNZ, called the Te Pae opening “a momentous shift in our city’s capability to host business events”.

Welcome to the Team

We are delighted to welcome our newest additions to the team – Hilary Little, Billy & Jackie Lomax, and Georgia Groves. Hilary joined our Property Management team late last year as a Property Manager, and Georgia started with us in May as an Assistant Property Manager. Husband and wife Billy & Jackie Lomax joined the Residential Sales team at the beginning of June.

Here is a little more about our newest team members.

Hilary Little:

Position at Cowdy: Property Manager.

Time living in Christchurch: I am from here originally and have been living back in Christchurch for about a year.

Education: Bachelor of Hotel and Institutional Management from Lincoln University.

Family: Akaroa is home, but I have a brother in Auckland and my sister, twin nephews and niece are in Brisbane.

Personal statement: After spending the last 11 years working on yachts, I’m thrilled to be transferring my skills to property management. I am enjoying the new and exciting challenge, and I couldn’t ask for a better company to work with than Cowdy and the team of talented property managers.

Previous jobs: Chief Stewardess on superyachts.

In my spare time: I love wakeboarding, sailing and hiking, as well as sewing, arts and crafts.

The charity I support the most: Nurse Maude and I Am Hope (Gumboot Friday).

Favourite home cooked meal: A Turkish dish called Karniyarik.

Favourite restaurant: Le Vietnamese Kitchen in Ponsonby.

Favourite holiday destination: Turkey.

Favourite thing to do in Christchurch: Catching up with friends.

Favourite TV show: The Bold Type.

Jackie Lomax:

Position at Cowdy: Residential Sales Consultant.

Time living in Christchurch: Since 1990 after returning from four years in London.

Education: Real Estate Sales Licence, Diploma Interior Design, NZ Certificate of Financial Services.

Family: I live with my husband, Billy, and between us we have four children and three grandchildren. We also live with our Shiatzu dog, Bruno.

Personal statement: I started my career in real estate eight years ago after meeting and teaming up with my now husband, Billy. I have always had a strong interest in the property market and love renovating houses. I am passionate about interior design and am an avid property investor.

Joining the team at Cowdy is the perfect fit for me, being a family business that takes great pride in what they do and the results they achieve for their clients.

Previous jobs: I have been selling real estate for eight years, but prior to this I was a sales rep for 16 years across several industries including commercial furniture, interior soft furnishings, beauty and fashion.

In my spare time: I like to go to the gym, pilates classes and generally stay active. I enjoy gardening and especially love spending time with family and friends.

The charity I support the most: The Cancer Society.

Favourite home cooked meal: Sunday roast with my family.

Favourite restaurant: Chiwahwah.

Favourite holiday destination: New York, Hawaii, and Wanaka at the family bach.

Favourite thing to do in Christchurch: Shopping, walks with friends and eating out.

Favourite TV show: Grand Designs and anything to do with house renovation and design.

Billy Lomax:

Position at Cowdy: Residential Sales Consultant.

Time living in Christchurch: I’m glad to have called Christchurch my home for the past 60 years. It’s a great city.

Education: I attended Shirley Boys’ High School and have a Bachelor of Commerce degree from Lincoln University. I’m currently studying an online course in high performance motor vehicle construction, engine building and tuning, in addition to learning to touch type. Wish me luck!

Family: I live and work with my wife, Jackie, and we have a small dog called Bruno. Between Jackie and I we have three children and three grandchildren living in Melbourne, as well as a daughter living in Christchurch. Most of my extended family live in Christchurch or nearby. They are a fun bunch of people so family gatherings always involve plenty of food and a great deal of banter!

Personal statement: I can still remember my first week in real estate. I was so excited I couldn’t sleep for a week. Thirty years on I’m still excited, but sleeping better. I have a simple philosophy: “listen to my clients, understand their goals, and make them happen”. As a real estate salesperson I’m always engaged in helping my clients move on to a better future. I find in doing so I also move on to a better future and that keeps me excited.

Previous jobs: I started my work life at Prudential Assurance as a junior clerk then moved to Whitcoulls as a stationary rep. I then ventured into self-employment as a water-blasting contractor and later as a spec builder. Upon finishing my degree thirty years ago I entered real estate sales and with any luck I’ve got another 20 years left in me.

In my spare time: When I’m not thinking about real estate I like learning new things. Documentaries interest me and with the advent of YouTube, the sky’s the limit.

The charity I support the most: Mike King’s Gumboot Friday. I heard Mike speak once and I think his charity can make a difference.

Favourite home cooked meal: Roast chook followed by rice pudding.

Favourite restaurant: I eat at Tutto Bene most Thursday evenings and Dux Central on Sunday. Chiwahwah Mexican Restaurant is another favourite. They make a mean Black Russian with coffee ice cubes!

Favourite holiday destination: It’s always been Nelson and the Sounds but I’ve recently enjoyed a great holiday in the Coromandel.

Favourite thing to do in Christchurch: I’ve started a car collection so my favourite thing to do is to get them out and take them for a drive, but only on dry days. On wet days I just stand and stare at them.

Favourite TV show: Currently it’s Wheeler/Dealer, but I also enjoy American Pickers.

Georgia Groves:

Position at Cowdy: Assistant Property Manager.

Time living in Christchurch: I grew up in Canterbury and moved back in early 2021.

Family: I have a beautiful baby girl, Imogen, with my soon-to-be husband Johnny. We also have a very naughty food thief in the shape of a whippet called Beauden. My family is very close, and my parents are amazing.

Personal statement: I am a very positive person with a passion for property and helping people, so making the move into property management felt like the right next step for me. The brand values at Cowdy really resonate with me so I’m thrilled to be part of the team here.

Previous jobs: For the past eight years I was a flight attendant for Air New Zealand, finishing off my career in long-haul. As much as I loved flying and exploring different countries, I’m so happy to have my feet firmly on the ground and have a new challenge in front of me!

In my spare time: I love spending time with my family, especially if food and wine is involved. I’m also a major history buff.

The charity I support the most: Other than the numerous gyms I have supported over the years, I am also an SPCA Guardian.

Favourite home cooked meal: A barbeque.

Favourite restaurant: Monsoon Poon in Wellington.

Favourite holiday destination: Anywhere, as long as it’s with the right people.

Favourite thing to do in Christchurch: I love the botanic gardens any time of year.

Favourite book: I can’t sit down long enough to read a book but give me the History Extra podcast and I’ll listen for hours.

Favourite TV show: The Office.

Understanding Housing Market Figures

NICK COWDY / Residential Sales Consultant, Principal Agent

As a serious home buyer, digging into housing market data can provide valuable insights, but it often takes experience to make sense of the numbers.

There is a wide range of information on house prices available from various sources, which can help home buyers to make sense of the market and gauge how much they should expect to pay for a property.

In particular, home buyers should make themselves familiar with data from the Real Estate Institute (REINZ), CoreLogic, OneRoof/Valocity, as well as surveys such as those from independent economist Tony Alexander and other sources.

Once you have all the data, a good place to get started is with a market insights report on a particular suburb.

Take Merivale in Christchurch for example. As a home buyer looking to buy in this area, you would likely start by looking at the median sales price for Merivale. The median sales price is the middle price between the highest and lowest sales recorded in the suburb during a given period of time.

It’s important to note that the median price is not the same as the average price, especially if there are outliers such as a few super-expensive properties or a bundle of cheaper ones, as these can skew price data.

The median sales price can be a good indicator of what buyers are paying, but the metric only reflects the sales prices of what has sold and can be distorted by the types of properties that have been on the market.

When looking at the data, it’s best to understand the value levels for the property you’re actually looking to buy, rather than looking at one general figure.

The next piece of data worth reviewing is the volume of properties for sale in the area you’re interested in. The number of listings can tell you whether there are a lot of properties on the market compared to usual, or fewer than usual. It can be easier to buy if there are more properties on the market.

For the likes of investors, determining the rent you can expect to earn and what your return will be after costs is important to consider.

To find out how much rent you might earn on a property, our team of property managers is able to provide you with a rental appraisal. Alternatively, you can visit the Tenancy Services website to find the current market rent in the area based on rental bonds. However, this may not necessarily be accurate in the current market, as it is a reflection of bonds lodged in the past six months and doesn’t take into consideration the condition of each property or their different features.

Rental yields are another thing to consider for an investor. This is usually the gross yield, which is the percentage of rental income against the purchase price of the property.

There is no shortage of data on the housing market out there, and understanding the figures empowers both buyers and sellers to make smarter decisions about buying or selling a home.

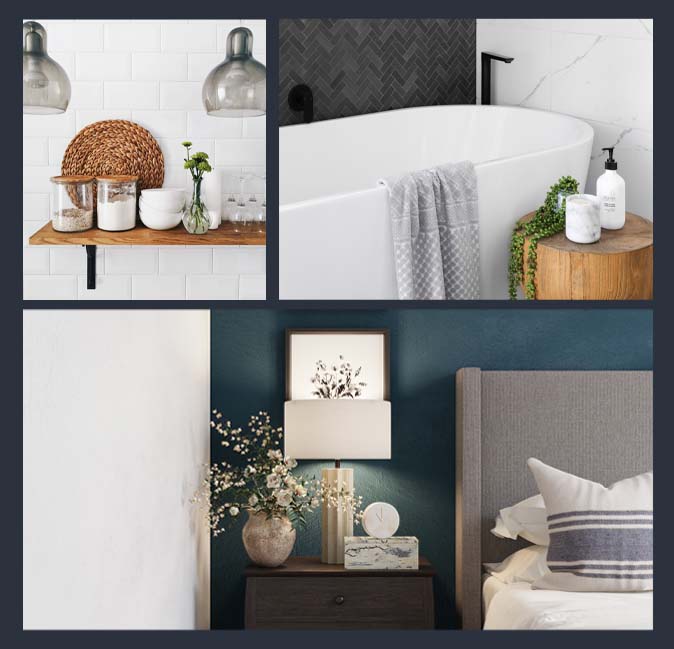

Benefits of Staging Your Home

While there is a lack of research to prove that investing in professional home staging when selling your home will yield a return, many real estate agents agree that it can greatly contribute to achieving a higher sale price.

At its most basic, home staging is designed to make your property more attractive to potential purchasers. However, it’s about more than just boosting your home’s kerb appeal or making it more inviting. Good home staging aims to evoke prospective buyers’ imaginations, encouraging them to imagine themselves living in the home.

The object of staging is to flatter the property, highlighting its good features and accentuating the space, while appealing to the largest pool of potential purchasers.

Removing personal items is crucial for proper home staging. If you have family photos, personal objects and memorabilia lying around, it makes it difficult for people to imagine the place as their own.

Home staging also focuses on decluttering, cleaning, and arranging furniture to maximise available space and make the rooms appear larger.

Some of the benefits of having your home professionally staged for sale are:

- Making your home look more luxurious, clean and comfortable

- Sparking emotion in potential buyers, which can help achieve a higher price and help the home to sell quickly

- Displaying a cohesive interior concept in photography – a staged home looks great in an online listing

- Highlighting the best features of the property

- Maximising the perceived space in the home

- Helping buyers to imagine themselves living there, and to fall in love with the property.

Changes to First Home Products

As part of Budget 2022, the government has announced changes to some of its First Home Products, which support first home buyers to overcome the deposit barrier to home ownership.

These products are the First Home Grant and First Home Loan, which sit alongside other initiatives to support first home buyers, including the Progressive Home Ownership Scheme, KiwiBuild programme, and First Home Partner.

The First Home Grant offers up to $10,000 to put towards a deposit for eligible first home buyers who have been contributing to KiwiSaver for at least three years. If you purchase an existing home, you can get $1,000 for each of the three (or more) years you have paid into KiwiSaver. The most you can get for an existing home is $5,000 for five or more years. If you were to purchase a new home or land to build on, you can get $2,000 for each of the three (or more) years you have paid into KiwiSaver. The most you can get for a new home or land is $10,000 for five or more years.

Click here to check if you are eligible for the First Home Grant.

The First Home Loan reduces the deposit requirement to 5% for eligible first home buyers (most lenders require a minimum deposit of 20%). First Home Loans are issued by selected banks and other lenders, and underwritten by Kāinga Ora, allowing the lender to provide loans that would otherwise sit outside their lending standards. The participating lenders are Westpac, Kiwibank, NZCU, The Cooperative Bank, SBS Bank, Unity, NBS and NZHL.

Click here to check if you are eligible for the First Home Loan.

To align with the current market, the house price caps for the First Home Grant have been updated to align with lower quartile estimated values for new and existing properties. In Christchurch, the cap on existing properties will rise from $500,000 to $550,000, and the cap on new build properties will rise from $550,000 to $750,000. Additionally, the house price caps on the First Home Loan have been removed entirely, meaning eligible applicants will have a greater choice of properties available to them.

To summarise the changes –

Changes to the First Home Grant and First Home Loan:

- Updating house price caps for the First Home Grant to align with lower quartile estimated values for new and existing properties

- Removing house price caps for the First Home Loan

- Introducing a new income cap category for ‘individual buyers with dependents’, with an income cap of $150,000

- Providing the higher new build grant to relocatable homes that have received a Code Compliance Certificate in the last 12 months

- Providing the higher new build grant to members of Progressive Home Ownership rent-to-buy schemes if their home was a new build when they moved in

- Adjusting the KiwiSaver requirements to reduce the threshold amount of regular savings to access the Grant

- Increasing the loan cap to $500,000 for Kāinga Whenua loans.

Changes to the First Home Grant came into effect on 19 May 2022 and the changes to the First Home Loan took effect from June 2022.

Further information on these changes can be found on the Ministry of Housing and Urban Development website here.

Join Our Mailing List

If you’d like to automatically receive a copy of our newsletter direct to your email, please enter the below form & we will be sure to add you to our database